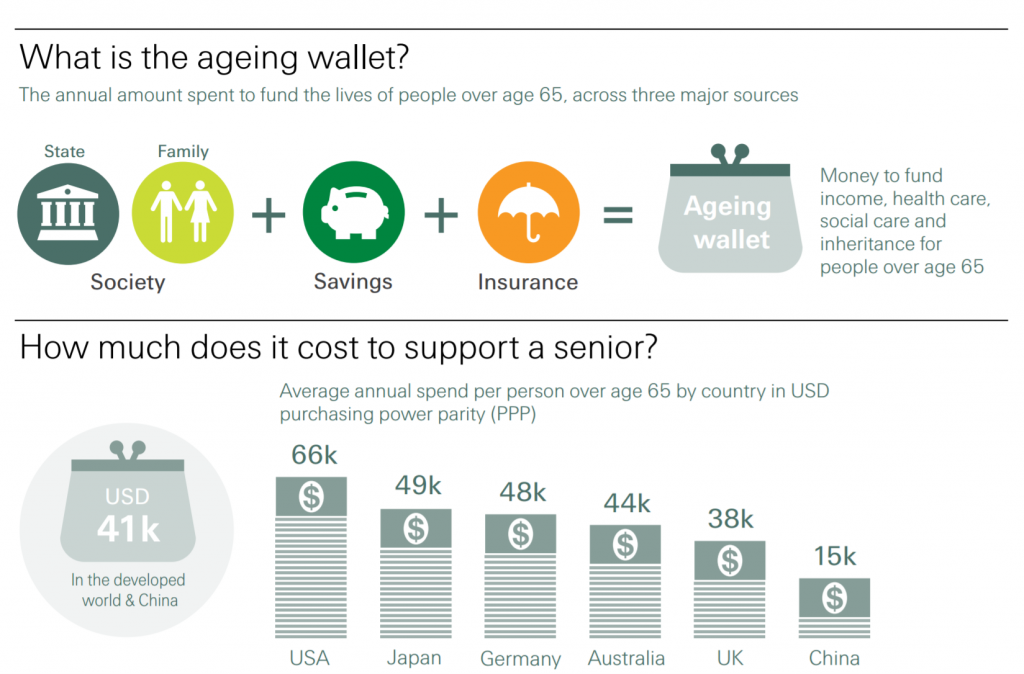

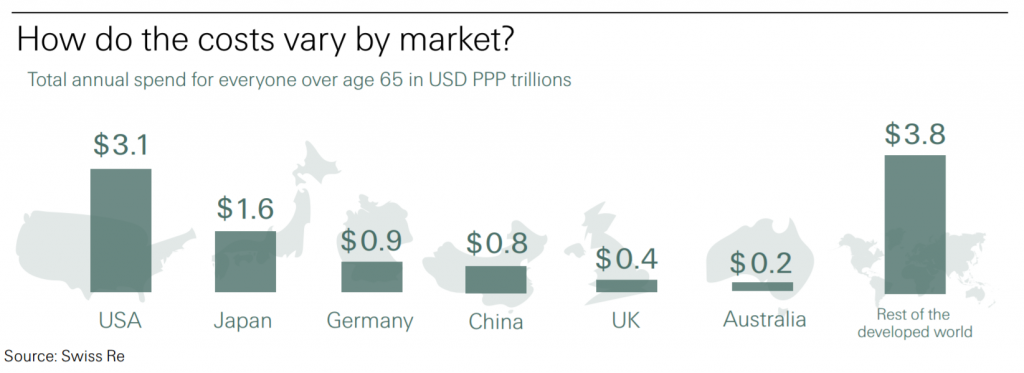

This study “Who pays for ageing?” by SwissRe shows the total amount spent on people aged 65 and over to supply their income, provide for their health and social care, and cover the inheritance they aim to pass along. It covers six insurance markets in detail (Australia, China, Germany, Japan, the UK and the US).

The study considers everyone who pays, across these three major sources:

1. Society: Care provided by the family and funding by the state

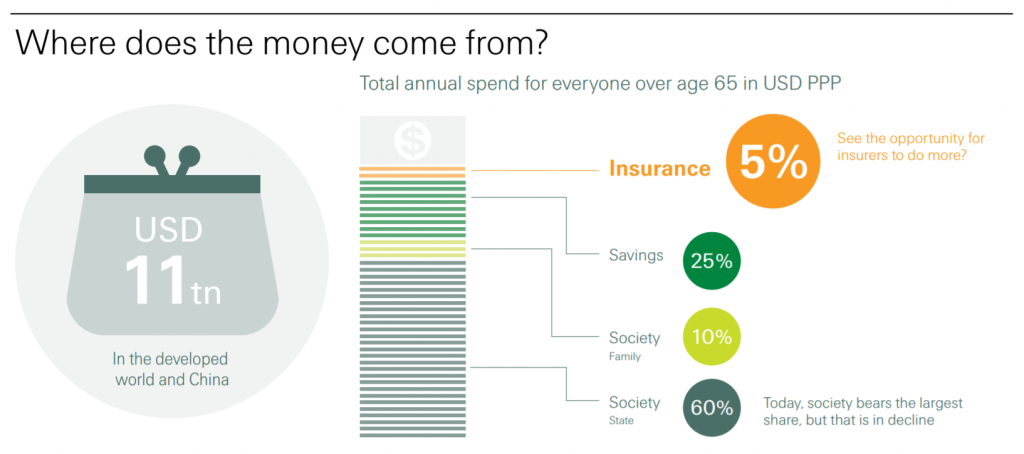

Society bears the largest portion – approximately 70% (60% state; 10% family). Each of the six markets has a different mentality towards, and reliance upon, state provision. However, the costs of public provision are projected to become unsustainable if current policies don’t change in the face of demographic shifts and other factors, such as high sovereign debt.

2. Savings: Private pension assets and housing

Savings account for a quarter of the ageing wallet. Though small in comparison to society’s share, private savings are increasingly important. As wealthier people tend to preserve their savings to guard against uncertainty and unknown long-term needs, they often don’t reinvest in, and benefit the overall economy directly.

3. Insurance products: Annuities and medical cover

Insurance has a fractional share of the ageing wallet – around 5%. Today the industry is generally focused on selling products like annuities and attempting to create a market for traditional long-term care insurance.

These results differ by market, from more social reliance in Germany, to more family focus in China, to more private savings in the US. Nevertheless, society holds the lion‘s share across all markets.

The current funding system will find it harder to meet the needs of our “new” older society. An uncertain life expectancy, increasing health and care needs, and other sociodemographic trends will bring substantially higher costs. More people will be vulnerable to lower standards of living due to insufficient funds available in case of major personal catastrophes such as chronic disease.

Re/insurers can provide relevant and useful solutions that are accessible to consumers, mitigate some of the costs of ageing and effectively compensate people when things don’t go according to plan.

Insurance can be an effective line of defence against ageing risks. The largest defence is currently provided by society, which lays the formal and informal foundation to basic needs such as a minimum income or family care. Accumulating savings over a longer working life also offers an important line of defence, which is traditionally used to finance a more comfortable standard of living in later years.

Insurance can smooth the decumulation phase, helping to protect against outliving one’s savings, unexpected health shocks, care needs and wider family issues.

The life and health industry’s current solutions only partially address these opportunities. Our collective success relies on a more thorough understanding of the very heterogeneous ageing population, and the various pathways to older age.

Insurance’s ability to support successful ageing as part of a wider ecosystem, which also includes charities, technology providers and others, is another important factor.

Leave a Reply