AARP conducted a study among family caregivers caring for an adult over the age of 18 to explore the out-of-pocket costs of caregiving and the financial strain on the family caregiver. This report estimates the monetary costs of caring for an adult with care needs by quantifying the out-of-pocket costs family caregivers are incurring. In addition to out-of-pocket costs, this study also explores other financial and personal strains that family caregivers may experience as result of caregiving.

Key findings include the following:

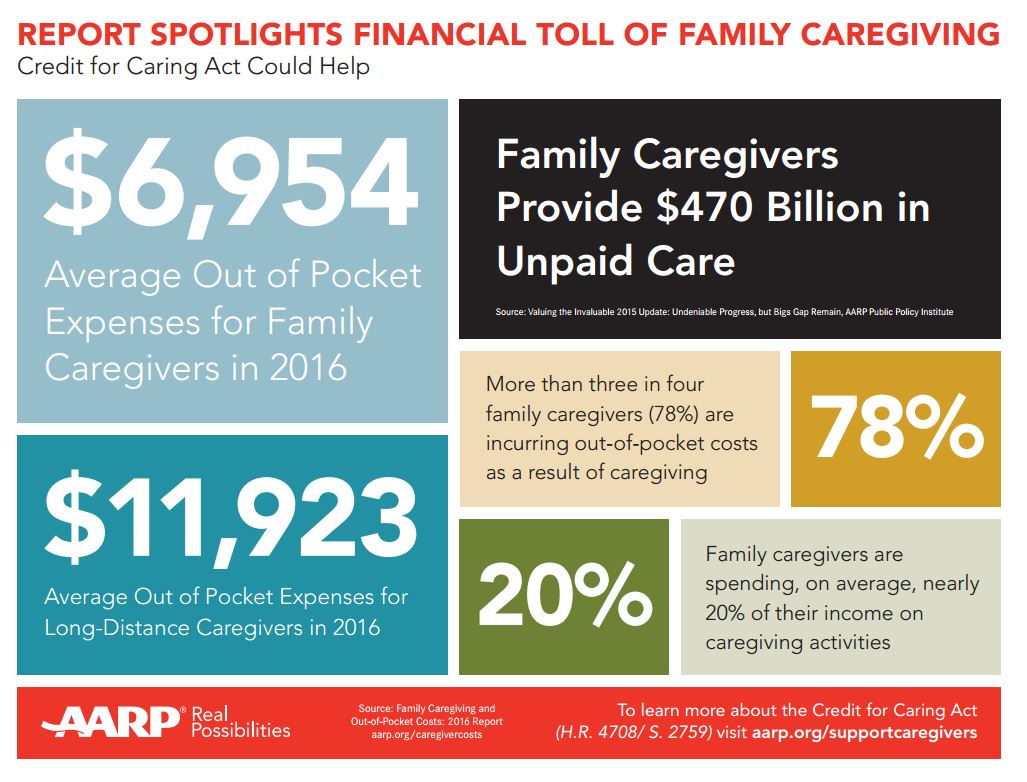

More than three quarters (78%) of caregivers are incurring out-of-pocket costs as a result of caregiving. This report estimates that family caregivers, on average, are spending roughly $7,000 per year ($6,954) on out-of-pocket costs related to caregiving in 2016.

A financial strain measure (annual caregiver expense divided by their annual income) shows caregivers are spending, on average, nearly 20% of their income on caregiving activities.

Household expenses garner the largest share of family caregivers’ out-of-pocket spending with 41% of total spending. This includes rent/mortgage payments, home modifications, as well as other household expenses. Medical expenses account for the second largest share of caregivers’ spending (25%) which includes assisted living or skilled nursing facilities, insurance costs, and other medical expenses.

Long-distance caregivers (defined as family caregivers living more than one hour from the care recipient) incurred the highest out-of-pocket costs ($11,923); however caregivers living with their care recipient also incurred high costs ($8,616).

Caring for an adult over the age of 50 results in slightly higher out-of-pocket costs than caring for an adult younger than 50 years old ($7,064 vs. $5,721). Caring for an adult with dementia also resulted in higher out-of-pocket costs ($10,697 vs. $5,758 for adults who do not have dementia)

More than half of employed caregivers (56%) experience at least one work-related strain. This may take the form of working different hours, fewer/more hours, and taking time off (whether paid or unpaid).

Many family caregivers also need to cut back on other spending which can undermine the family caregiver’s future financial security. One in six have reduced contributions to their retirement savings (16%) and roughly half have cut back on leisure spending (e.g., 45% cut back on eating out or vacations as a result of caregiving expenses).

Leave a Reply